Trump’s Bitcoin reserve strategy could reshape global crypto market dynamics. The U.S. proposal targets Russia’s rising crypto influence, setting up a direct crypto reserve comparison. President-elect Donald Trump’s NYSE announcement pushed Bitcoin past $100,000, marking a new phase in the global crypto impact. This development intensifies the financial rivalry as both nations race to establish strategic cryptocurrency positions.

Also Read: Dogecoin: Can DOGE Hit $0.90 After Bitcoin’s New Peak?

Will Trump’s Bitcoin Reserve Plan Beat Russia’s Crypto Strategy to Reshape Global Markets?

Trump’s Bold Bitcoin Move

Senator Cynthia Lummis introduced the Bitcoin Act, showing Trump’s Bitcoin reserve commitment through a five-year plan for 1 million Bitcoins. The U.S. holds 200,000 confiscated Bitcoins worth $20 billion as the foundation. Trump’s NYSE statement outlined the crypto market strategy: “We’re gonna do something great with crypto because we don’t want China, or anybody else… but others are embracing it, and we want to be ahead.”

Russia’s Counter Strategy

The Russian crypto war response emerged through State Duma deputy Anton Tkachev’s proposal. His Bitcoin reserve plan addresses Western sanctions, strengthening Russia’s financial position. At the VTB Investment Forum, Putin validated the crypto market strategy, declaring, “Nobody can ban Bitcoin.”

Also Read: Ripple: How High Will XRP’s Price Be 5 Days From Now?

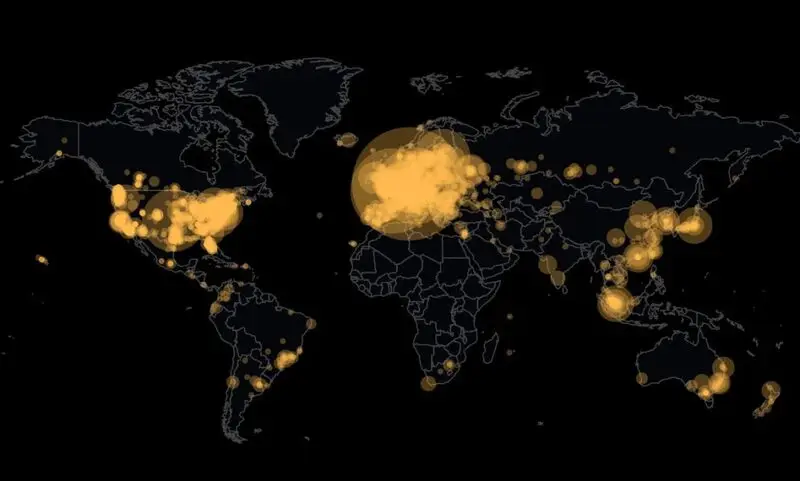

Global Financial Battleground

Trump’s Bitcoin reserve requires $100 billion at current prices, directly challenging Russia’s crypto war tactics. This global crypto impact transforms international finance. Both nations view Bitcoin reserves as crucial economic tools, reshaping worldwide trading relationships.

Market Response and Future Implications

Markets watch how the U.S. and Russia handle crypto differently. Trump’s win and Bitcoin plans pushed prices up. Russia looks for new ways to move money. Tkachev emphasized that “cryptocurrencies are becoming virtually the only tool for international trade” for sanctioned nations, showing how crypto plans are changing.

Also Read: Bitcoin Hits New Peak Of $106,000: Will BTC Hit $120,000 Next?

Strategic Advantage

Trump’s Bitcoin reserve initiative appears stronger than Russia’s crypto plans no matter if it becomes a Russia crypto war or not. The U.S. shows aggressive investment and faster implementation in this crypto war. Russia maintains a defensive position. This competition accelerates cryptocurrency’s integration into global financial systems.